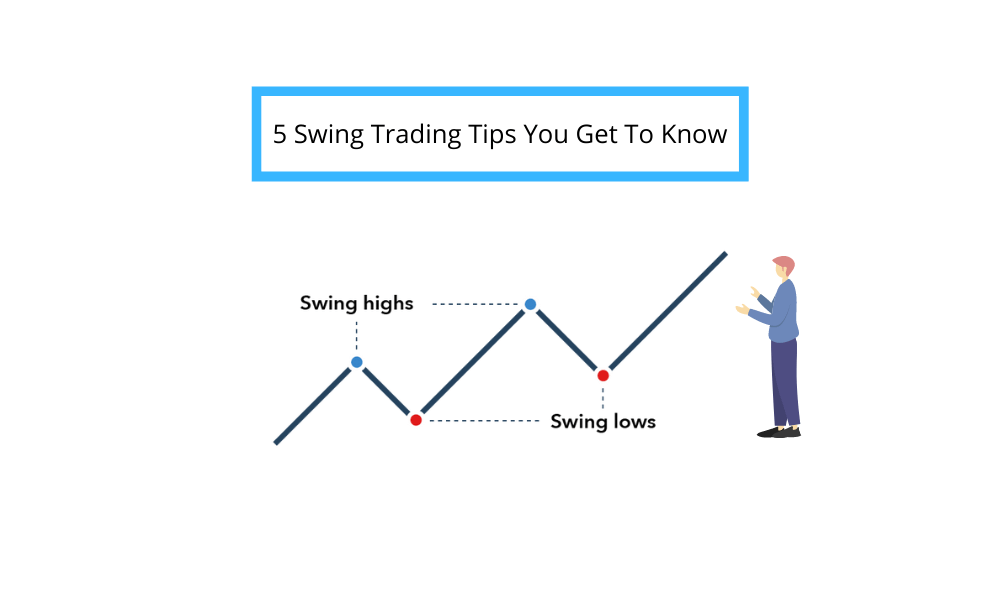

This article provides a more critical gander at swing trading procedures and standards. It's memorable's critical that swing trading is a hazardous venture procedure, and it ought not to be an undertaking that is trifled.

By contemplating and joining these swing trading tips and fools into your current market structure, you can more readily comprehend the stuff to turn into a more effective swing broker.

Begin with the market's essential and middle-of-the-road patterns (as estimated by the S&P 500), which can give the setting to each merchant to settle on transient trading choices.

On the off chance, you possibly center around the present moment - regardless of whether your exchange is an effective temporary period - the more significant patterns will probably reassert themselves. In the best-case scenario, your benefit potential will be restricted.

Recent Topic

European Commission Opens New Consultation On Digital Euro

Elon Musk - The Man Behind All Odds

Can Bitcoin Seal Its Best Weekly Close Of 2022? BTC Price Sits At $46.5K

You want to recognize the more extended term patterns to ensure you accept circumstances for what they are (not against them).

'Shocks, for example, news declarations, investigator updates/minimize, and procuring hits/misses frequently happen toward the more significant patterns. Traders should know where the S&P remains comparable to its more extended period moving midpoints (40-, 30-, 10-week).

When you know the general pattern, don't battle the tape: Look for lengthy exchanges during times of bullishness and track down proper short conversations during times of negativity.

For instance, expecta bear market where the 40-and 10-week moving midpoints slant descending and the S&P is underneath both. Here, you ought to search for stocks to go short.

While conceivable, fusing "Cost Relative" to the S&P 500 into your diagram examination should let you know how the particular stock behaves according to the general market. During bear markets, search out stocks whose broad strength line is declining compared to the S&P. Do the inverse during positively trending markets.

Consider moving midpoints to adjust the short-and middle of road term patterns (even though swing traders focus solely on the present moment). Be that as it may, this specialized examination will constantly be halfway or restricted because these traders can't appreciate the situation from start to finish.

Then again, don't zero in only on the basic pattern while swing trading since there will be periods where the transitional pattern turns positive, and stocks take off.

Energized by short-covering, the S&P 500 and other significant midpoints can climb 20% or more in a time of only half a month during bear market rallies. In the interim, unstable stocks with high 'betas' can move more than this.

Even though you're a momentary broker, it's crucial to know when the transitional term pattern changes (and when a countertrend rally is grabbing hold).

Utilize your telescope and magnifying instrument because excessively little of a "think back period" can be dishonest (and expensive).

While investigating a stock, a two-year week-by-week diagram is excellent for checking the master plan out. To decide the general pattern, look at the offers corresponding to a drawn-out moving normal.

Then, direct your concentration to the simple half-year diagram. Here, you'll see better subtleties that the week-by-week chart darkens. The more limited term moving midpoints can determine a stock's momentary pattern.

At long last, focus on the hourly diagram to uncover the overall pattern in the course of the most recent couple of weeks. It is beneficial here to Move midpoints.

It's never past the time to jump on the lift, yet the speedier you perceive a pattern, the more productive your exchange will be (and the less gamble you'll expect). The main advance is to give close consideration to the general market midpoints.

Whenever they're overbought or oversold, they're generally inclined to inversion. Whenever the market tests a significant zone of help and obstruction, it's precious to take a gander at new highs, new lows, and the development/decline line.

|

|

Generally, modern/non-asset stocks like papers, metals, oil, and gold are exceptionally related to the heading of the general market. This way, when the market turns, they're probably going to turn. Candles and energy pointers (for example, RSI and stochastics) are "early admonition lights" that frequently expect or lead to a turn in the stock.

Challenges can be exchanged on either a main or an unexpected result, contingent upon your ability to face risk. Whenever the two kinds of signs have been given, you can, for the most part, enter the exchange with a higher likelihood of accomplishment.

Then again, trendlines and moving regular hybrids are unexpected results that affirm the message of the early advance notice signals.